View a screenreader-friendly version of this page.

The perfect formula for the register

JUNE 2025

Leveraging new data to build the perfect checkout experience for shoppers.

Building the Ideal Consumer Interaction

Imagine you’re walking into the grocery store: you have a list in hand, and you have things to buy. But when you leave, you notice you purchased more than planned. How does a store know where to place things so perfectly that they end up as part of the register ring?

The ARC Large-Store Study, surveying roughly 4,000 shoppers, examines consumers' shopping processes and preferences in Mass, Grocery, and Dollar Channels. The study shows potential ways to optimize and innovate for shopper satisfaction and offers valuable insight into what delivers the most success for all stakeholders.

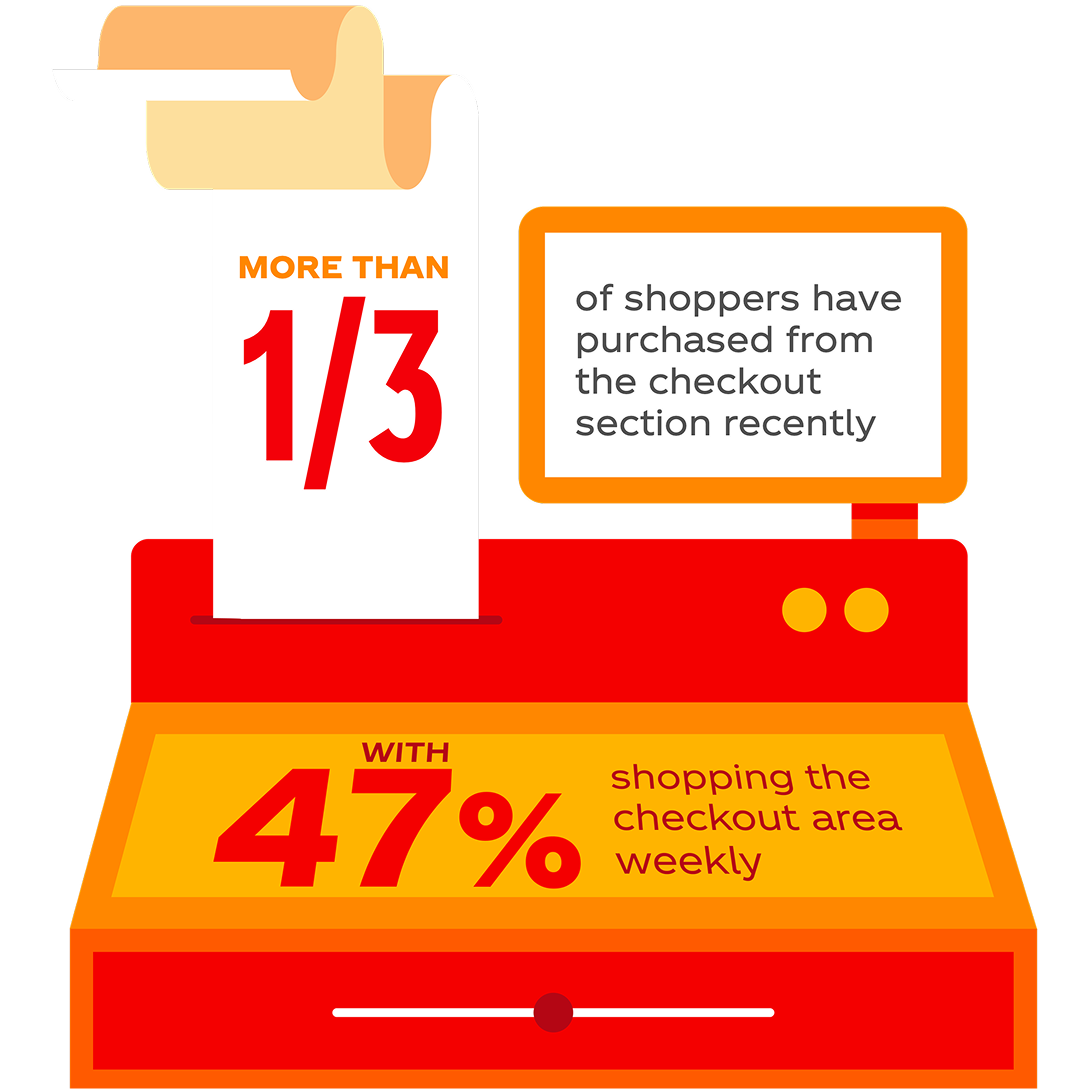

Checking Out the Checkout

The checkout area is considered a high-traffic zone, with similar purchase rates to special displays. The checkout is where impulse purchases thrive which boosts incremental sales. This area is also beneficial for reaching hard-to-target demographics, like:

- Males

- Gen Z & young Millennials

- Multicultural consumers

However, with low-cost, treat-oriented purchases, price promotions and discounts have minimal influence at checkout. Mass merchandisers lead in self-checkout usage, with higher shopper satisfaction compared to cashier lanes. In Grocery, however, cashier checkout dominates, especially in the South and limited-assortment stores.

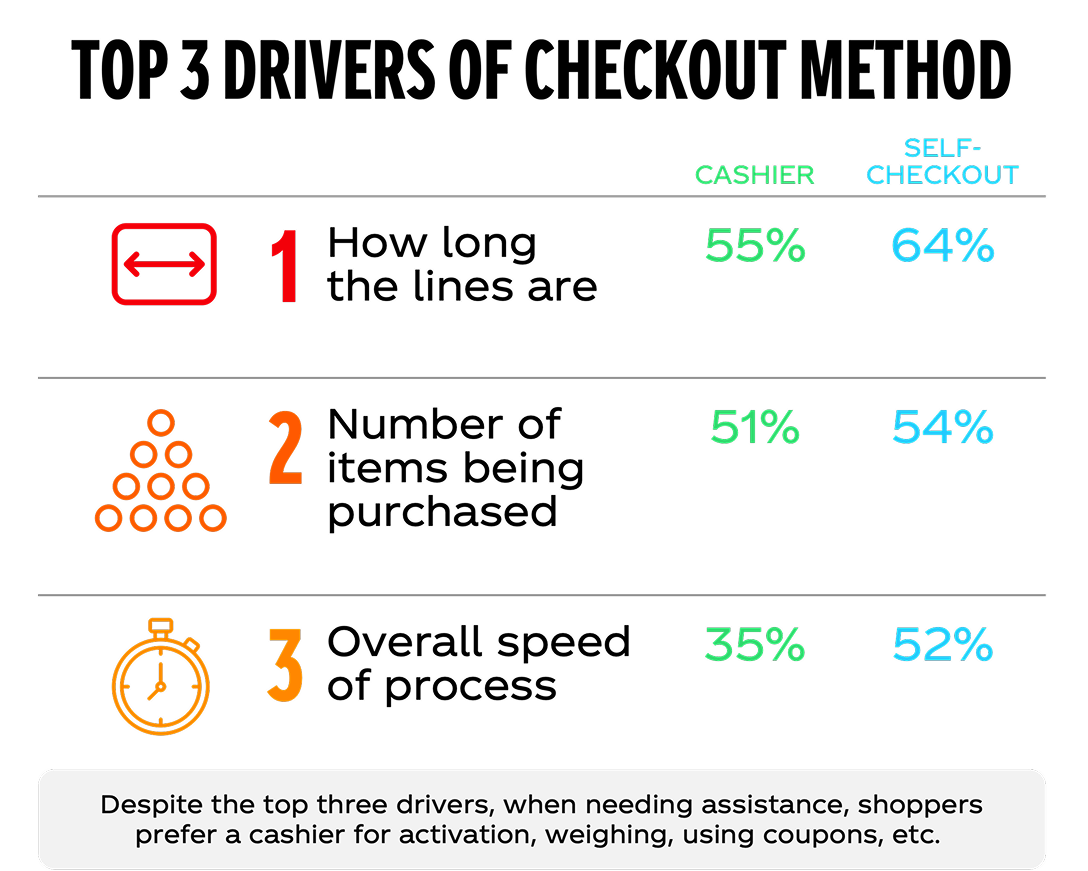

Self-Checkout vs Lanes

The logistics of where shoppers check out in the store can depend on a wide variety of factors, including who the shopper is. Generally, 58% of shoppers use a blend of both self-checkout and cashier lanes. The checkout option shoppers choose can vary for a multitude of reasons.

In most channels, shoppers report wanting more cashier lanes, outpacing the desire for additional self-checkout lanes. They prioritize shorter lines over speed, with basket size influencing their choice of checkout method. One of the main reasons shoppers prefer human interaction is concern over glitchy self-checkout systems. Retailers can also use this desire for human interaction to leverage cashier lines for real connections with shoppers, improving satisfaction and driving loyalty. However, they still favor improvements to current systems over entirely new high-tech options.

What Gets Attention?

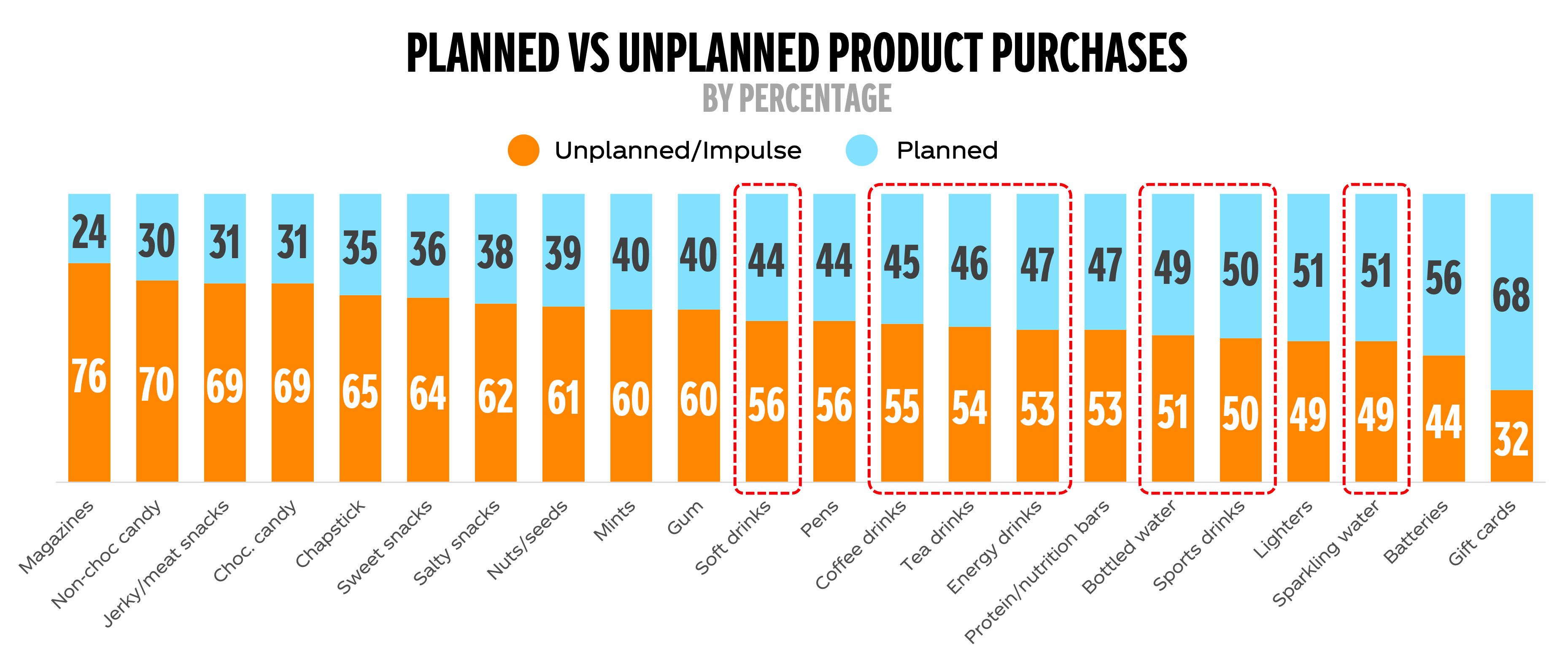

Beverages are more likely to be both a planned and impulse purchase, while snacks and confections capitalize on impulse and shopper curiosity for new products. Most are happy with the checkout product mix, though some want select staples available, or healthier items like high protein or low sugar. Snack shoppers have varying levels of commitment, though a third choose a line based on their desired snack. Beverage shoppers, on the other hand, are more willing to go out of their way to grab a preferred product from another line, likely from a cooler. Many checkout purchases include two items, so retailers should ensure each checkout area merchandises beverages, snacks and candy for best success.

The Express Lane

The modern shopper’s journey is now a never-ending experience. It’s important to understand how to connect with them throughout that journey to help create the ideal visit.

Looking at the big picture:

- Having products at checkout hits hard-to-reach demographics.

- Shoppers don’t focus on promos and discounts as much when looking at impulse.

- Most prefer to use a blend of self-checkout and lanes depending on which is the most effective at the time—line length being the biggest decision maker for most.

- Beverages are more likely to be a planned part of the purchase, and people will go out of their way for their preferred drink.

By elevating the ARC study findings, total register ring could be the best yet. Looking for more in-depth data from the ARC study? Contact your Coca‑Cola Representative for more.

ARC Global- Front End Research, January 2025

Want to see more?

Discover more through the lens in the articles below.